1-800-830-1055

1-661-253-3303

Offshore Captive Insurance Company Formation

Offshore Captive Insurance Company Formation

Consultations

FREE Consultations on offshore business formation and asset protection from lawsuits.

CALL 1-800-830-1055

Please Activate the Contact Form plugin from admin section then you can show the formOffshore Captive Insurance Company Formation

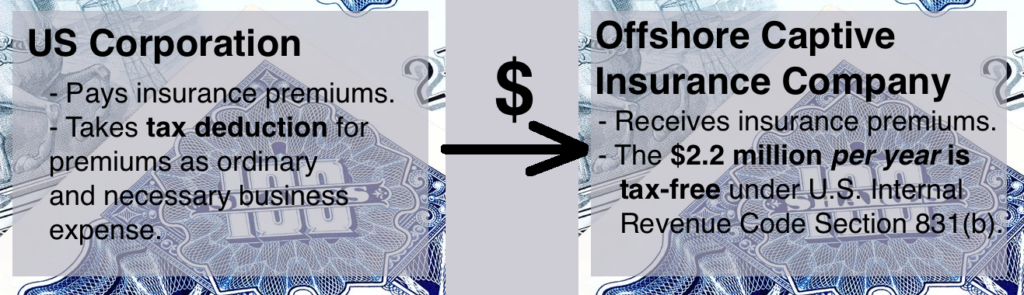

Offshore captive insurance company tax benefits and savings on insurance premiums are two of the many reasons that attract so many businesspeople to set up such an entity. For example, research shows that about 80% of the Standard and Poor 500 (S&P 500) companies own one or more captive insurance companies. Offshore captive insurance is the main source of insurance for both large and small companies. U.S. Internal Revenue Code Section 831(b) specifically allows for a particular type of insurance where the insurance company is owned by the shareholders or principles of the insured company. The insured, related company which pays the premiums into the plan is allowed a tax deduction for the premiums as an ordinary and necessary business expense.

How Does a Captive Insurance Company Work?

Insurance premiums are paid by the companies (and/or individuals) being insured. The funds are deposited into an account held by the captive insurance company. The insurance company is often owned by the same party or parties that own the company(ies) being insured. So rather than an outside insurance company profiting from the premiums and claims, those who established the entity can benefit from the profit that would normally be realized the the institutional insurer.

Captive Insurance Company Tax Benefits

The company paying the premiums receives a tax deduction, and the captive insurance company receiving the premiums receives the first $2.2 million tax-free. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under IRC Section 953(d). It will, therefore, file US tax returns annually. However, premium income up to the first $2.2 million is exempt from taxation. In the following calendar year, another $2.2 million can be contributed, for a total of $4.4 million over two years, $6.6 million in premiums are tax deductible over three years, etc.

Offshore Captive Insurance Definition

A captive insurance company is an insurance company that is owned and controlled by the ones being insured. So, its main purpose is to insure the risk of its owners while allowing them to benefit from the underwriting profits. Laymen may refer to the arrangement as self-insuring, alternative risk transfer or alternative insurance.

Offshore Captive Pros and Cons

Financial havens with strong insurance statutes are the locations where most companies are formed. In addition to the tax benefits described above there are several additional convincing reasons why captive offshore insuring vehicle should be considered. One is able to “self insure” to an extent not available otherwise. The cost of insurance can be significantly reduced. Plus, risk management is enhanced. Moreover, if a standard policy is not available or extraordinarily expensive, the plan may be the only viable option. Professional malpractice, pollution and hazardous materials as well as catastrophic risk are excellent examples of rates-gone-awry. US insuring companies frequently raise rates or deny coverage without warning. Whereas, owning your own offshore captive company can give your plan longstanding solidity and direct access to reinsurance markets.

Whereas offshore captive insurance companies can offer significant savings on insurance premiums and significant tax benefits, one contrary point is that they are not inexpensive to establish or operate. There is the initial setup fee, the captive insurance manager and the annual renewal costs. The costs vary from place to place so it is best to use the number of form that is located here in order to obtain additional information. The key is to make sure that sufficient income is being produced by the insured party(ies) so that the money saved in taxes and premiums far offset the initial and annual costs.

Domestic vs. Offshore Captive Insurance

There are some US states and at least one Canadian province with statutes on the books that enable domestic captives. However, there are particularly attractive benefits to going offshore. These include significantly lower costs, possible tax benefits and fewer regulations.

Investing Premiums

The money inside the insurance company is, in turn, invested. One popular and stable choice is to invest the money with a Swiss bank account that has a money management division. Whereas the premiums are deductible and the company receives premiums tax-free, naturally, income that is generated from the investment activity is taxed annually.

Types of Captive Insurance Companies

A captive is a wholly owned subsidiary of a company that is not primarily in the insurance industry. Its main function is to insure some or all of the risk of its parent company. As the industry has grown those involved have sought new methods of enhancing the captive structure to create means by which a variety of industries can benefit. Here are a number of different structures a are being used;

- Single Parent Captives – Only underwrite the risk of related group companies.

- Diversified Captives – Underwrite unrelated risk in addition to related group companies.

- Association Captives – Underwrite the risk of members of a specific industry-type or trade-association. Medical malpractice is often insured in this fashion.

- Rent-A-Captives – Companies that offer access to captive structures without needing to establish one’s own insurance company. The participant pays for the use of the company and needs to provide collateral so that the rent-a-captive is not exposed to substantial risk experienced by the participant.

- Special Purpose Vehicles (SPV’s) – Used to secure risk. These are reinsurance companies that execute contracts with their parent company and yield the risk to risk the capital markets. This is typically accomplished by a bond issue.

- Agency Captives – Established by insurance agents or brokers to enable them to participate only in low-risk activities under their control.

Captive Insurance Requirements

To comply with IRS requirements, the captive insurance company premiums need to exceed investment income. Additionally, the policies that the captive issues need to comply with the “risk distribution” and “risk shifting” requirements. In order to comply, the company can obtain reinsurance. This is done in the international reinsurance markets whereby “pooling” arrangements are utilized. This can successfully minimize the costs and the help to protect against to claims by unrelated companies. The finer points and investment required to establish the structures depend on the needs and desired outcomes.

Captive Insurance Accounting

Because this technique is common among many well-know companies, there are a number of highly regarded accounting firms that deal with the necessary tax and reporting duties for statutory captives.

Captive Insurance Company – Not a Listed Transaction

The IRS has issued Notice 2004-65 which has successfully de-listed the Section 831(b) statutory captive insurance company as a tax shelter. So, it is not a listed transaction and the IRS does not require special notification that one is participating in such a program. IRS Commissioner Mark. W. Everson has states, “Based on disclosures from taxpayers and examination of tax returns, we have determined problems associated with these transactions are no as prevalent as initially believed. Accordingly we are no longer classifying them as listed transactions.”

See Captive Insurance Minimum Capital and Surplus Requirements by jurisdiction.

For More Information

Offshore captive insurance offers some significant benefits to many companies, including small to large Fortune 500 firms. To form a captive insurance company, please feel free use the number or form on this page.

This purpose of this page is to give a general overview of the subject matter. It involves complex legal and tax planning knowledge. It is not intended to give nor should it be considered tax or legal advice.

Consultations

FREE Consultations on offshore business formation, and asset protection from lawsuits.

CALL 1-800-830-1055

Please Activate the Contact Form plugin from admin section then you can show the formRelated Items

Array![]()

I learned a lot about how exposed I was to lawsuits and judgements, I protected my wealth with several instruments.

![]()

- J.P. Dumini

![]()

I’ve learned that nobody wins in a lawsuit, the only way to ensure that you don’t lose, is to have something in place when you need it.

![]()

- J.M. Ansen, Los Angeles

Why Protect Yourself?

Services, Plans & Strategies

Satisfaction Guarantee

We are committed to providing a quality service and accurate filing product package. We pride our-selves on putting the customer’s financial future first and foremost.

- Offshore Company, Inc

- 28015 Smyth Drive #200

- Valencia, CA 91355

- United States of America

- Telephone 800-959-8819

- International +1 661-282-2084

© 2015 offshore company, inc